HAPPY NEW YEAR FROM TELEO CAPITAL!

2019 was a very productive year. We completed 3 platform acquisitions, expanded the team to 12 and most importantly, strengthened our team-oriented culture. While 2019 was certainly a year full of accomplishments, we are excited about the prospects that lie ahead and confident we have the right team to execute our strategy in the lower middle market.

Sincerely,

TELEO CapitalTELEO ADDS THREE PORTFOLIO COMPANIES

Industrial Defender

Acquired in December 2019, Industrial Defender provides cybersecurity and compliance solutions for critical infrastructure providers globally.Paxia

Acquired in June 2019, Paxia, a provides enterprise SaaS applications for managing the in-flight catering services supply chain for the airline industry.UMT360

Acquired in March 2019, UMT360 provides enterprise project portfolio management (PPM) software to help clients align the execution of projects with their business strategy.TELEO WELCOMES THREE NEW TEAM MEMBERS

Matt Oehlmann

Matt has deep investing expertise bringing over 15 years of sourcing experience in the lower middle market. A member of TELEO Capital Investment Committee, Matt’s primary focus will be deal origination, qualification, portfolio monitoring and investor relations.

Connor Martin

Connor’s primary responsibilities include deal origination and qualification. Prior to joining TELEO, Connor was an Associate at Criticalpoint Capital where he helped lead business development efforts.

Joseph Roark

Joe brings over 20 years of global operating partner, investment partner, chairman, CEO, and president experience in private equity, public, and privately held businesses across a variety of industrial and technology markets.

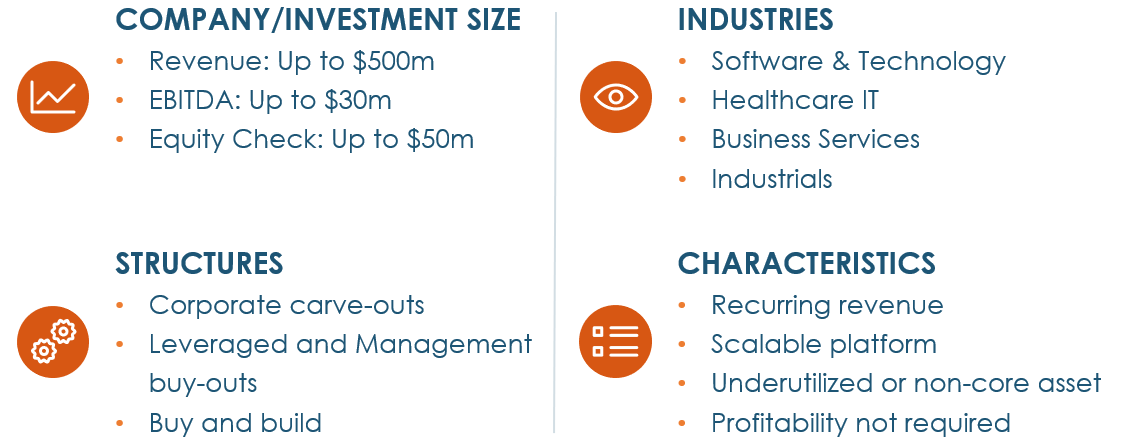

TELEO INVESTMENT CRITERIA

CULTURE BUILDING AT TELEO

SPARTAN RACE

ABOUT TELEO CAPITAL

TELEO Capital is a lower middle market private equity firm that looks to invest in opportunities where its strategic thought, operational resources and capital base empower management to perform and execute their business plan. We bring a successful track record of executing corporate carve-outs, recapitalizing broken balance sheets, acquiring founder-owned companies, as well as buy and build strategies for our portfolio companies.