HAPPY NEW YEAR FROM TELEO CAPITAL!

2020 was a monumental year for TELEO Capital. Our inaugural fundraise (TELEO Capital LP) was successfully completed in November, reaching $250M from a blue-chip roster of institutional limited partners. We acquired Rand McNally, a market leader in fleet management and telematics technology. In addition, we added an office in Boise, Idaho and have grown to 16 professionals, expanding across business development, transaction execution and operations. While 2020 was a year unlike any other we have experienced, we look ahead with confidence in the team we have built, our strategy and the opportunities that lie ahead.

Sincerely,

TELEO CapitalTELEO Raises Inaugural Fund and Adds Rand McNally

Inaugural Fund

TELEO Capital, LP Closes $250 Million Inaugural FundRand McNally

Acquired in November 2020, Rand McNally is a leader in the fleet management software market.TELEO WELCOMES SIX NEW TEAM MEMBERS

John McCormack

John brings over 25 years of C-level executive leadership experience in the cybersecurity technology and infrastructure software industries.

Eric Guo

Eric’s primary responsibilities include deal qualification, due diligence, transaction support and execution, and portfolio monitoring.

Kristine Croft

Kristine's primary responsibilities include financial due diligence, operational improvements, and financial reporting.

Erin Warwick

Erin's primary responsibilities are to support the Operating Partners in on-boarding and oversight of new portfolio companies.

Kelly Blake

Kelly’s primary responsibilities include deal qualification, due diligence, transaction support and execution, and portfolio monitoring.

Andrew Ely

Andrew’s primary responsibilities include sourcing and qualifying add-on acquisitions for the firm’s existing portfolio companies.

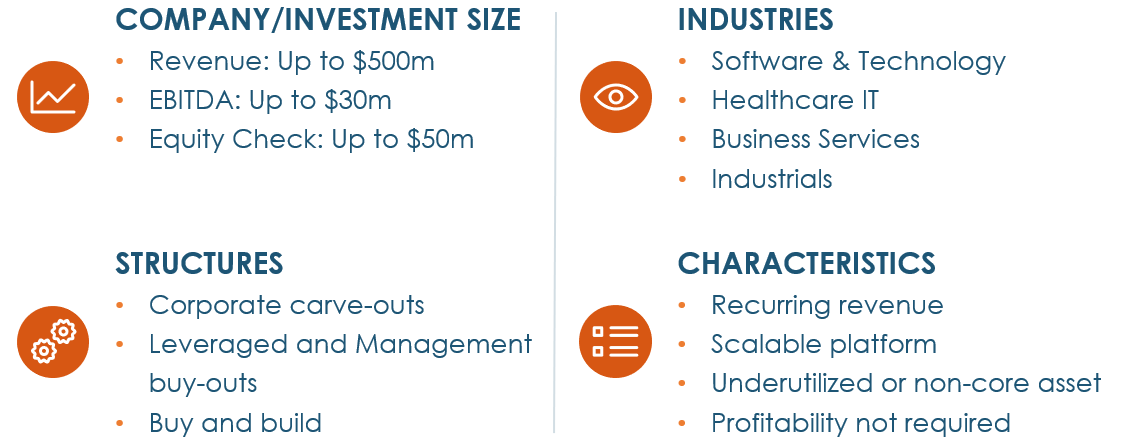

TELEO INVESTMENT CRITERIA

ABOUT TELEO CAPITAL

TELEO Capital is a lower middle market private equity firm that looks to invest in opportunities where its strategic thought, operational resources and capital base empower management to perform and execute their business plan. We bring a successful track record of executing corporate carve-outs, recapitalizing broken balance sheets, acquiring founder-owned companies, as well as buy and build strategies for our portfolio companies.