HAPPY NEW YEAR FROM TELEO CAPITAL!

2022 was a year of continued growth for our firm. We announced 2 new platform investments and gained momentum with our buy-and-build strategy by completing 3 follow-on acquisitions. We further added to our sourcing, execution, and operations expertise with the hiring of 4 new team members. Since our founding in 2018, we have completed 10 platform investments and 4 follow-on acquisitions. Our team now totals 27 seasoned investment professionals.

We are thankful to everyone who has contributed to our progress. We look forward to a great 2023.

Happy New Year,

TELEO CapitalPlatform Acquisition Announcements

CHCS Services, Inc.

CHCS specializes in supplemental health care solutions for senior markets with a focus on long term care (LTC) and Medicare Supplement (MedSup) plans.

READ MOREFollow-on Acquisitions

Fleetsu

The acquisition of Fleetsu, a cloud-based, data analytics fleet management solution provider, aligns with Rand McNally Fleet’s strategy to significantly increase its investment in best-in-class solutions for the transportation market, and more specifically, the connected vehicle sector.

READ MOREWestern Principles

The acquisition of Western Principles, a provider of Project Portfolio Management consulting services, follows UMT360’s acquisition of FIOS Insight, a leading Enterprise Architecture software tool. The integration of these businesses strengthens UMT360’s Strategic Portfolio Management product, creating an end-to-end enterprise project solution.

READ MORETELEO WELCOMES FOUR NEW TEAM MEMBERS

KEVIN HATCH

Kevin brings over 20 years of financial, operational, and executive leadership experience, including a decade working with private equity portfolio companies, to TELEO Capital. Kevin most recently served as an executive of Avalex Technologies and as CFO / Acting CEO of AppRiver.

GEOFF VASUDEVAN

Geoff’s primary responsibilities include advisement and support on strategy execution and business process improvement for portfolio companies. Geoff most recently worked with Avalex Technologies and RCD Equity.

DONTÉ HARRINGTON

Donté's primary responsibilities include deal origination and qualification. Donté is a recent graduate of Boise State University, where he was an offensive lineman for the Boise State football team.

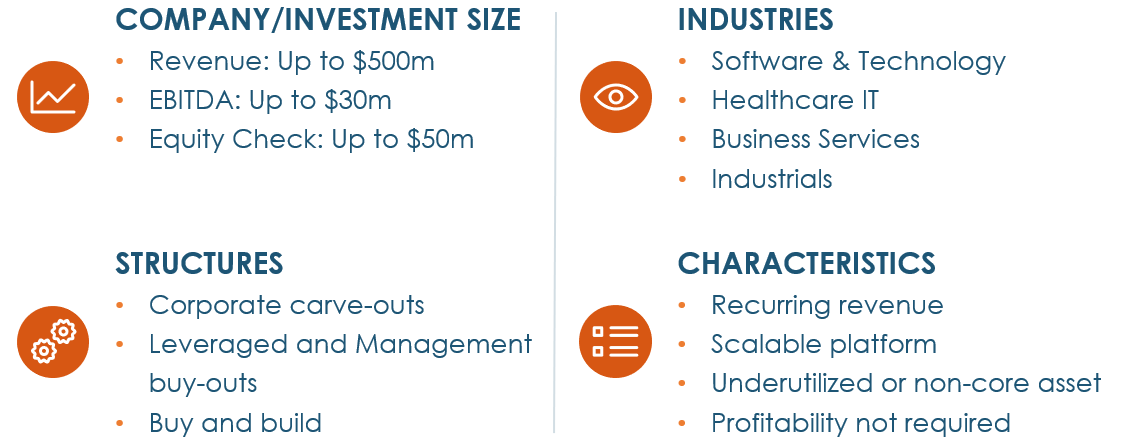

TELEO INVESTMENT CRITERIA

ABOUT TELEO CAPITAL

TELEO Capital is a lower middle market private equity firm that looks to invest in opportunities where its strategic thought, operational resources and capital base empower management to perform and execute their business plan. TELEO brings asuccessful track record of executing corporate carve-outs, recapitalizing broken balance sheets, acquiring founder-owned companies, and implementing buy and build strategies for its portfolio companies. TELEO targets opportunities in the technology & software, healthcare IT, business services, and industrial sectors. The firm is headquartered in Boise, ID with an additional office in Los Angeles, CA.